Land investment has shown notable trends and insights over the past year, reflecting its potential as a valuable investment strategy. Let’s explore these developments and compare them with other investment options like the stock market.

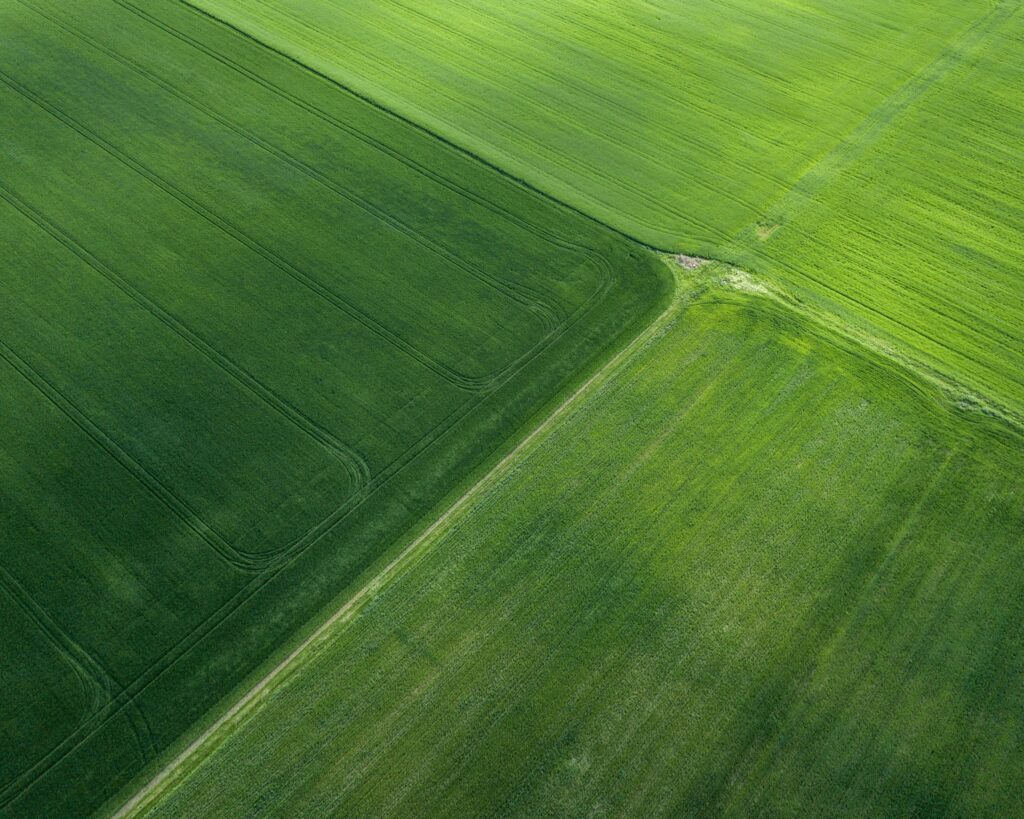

In 2023, the value of land investments, especially farmland, continued to rise. The surge in demand for land, driven by factors like agricultural needs and conservation efforts, has kept land prices robust. For example, farmland values reached new heights in 2022, and while experts predict that this growth might peak in 2023, the values are expected to remain strong due to ongoing competition and favorable agricultural conditions (Successful Farming).

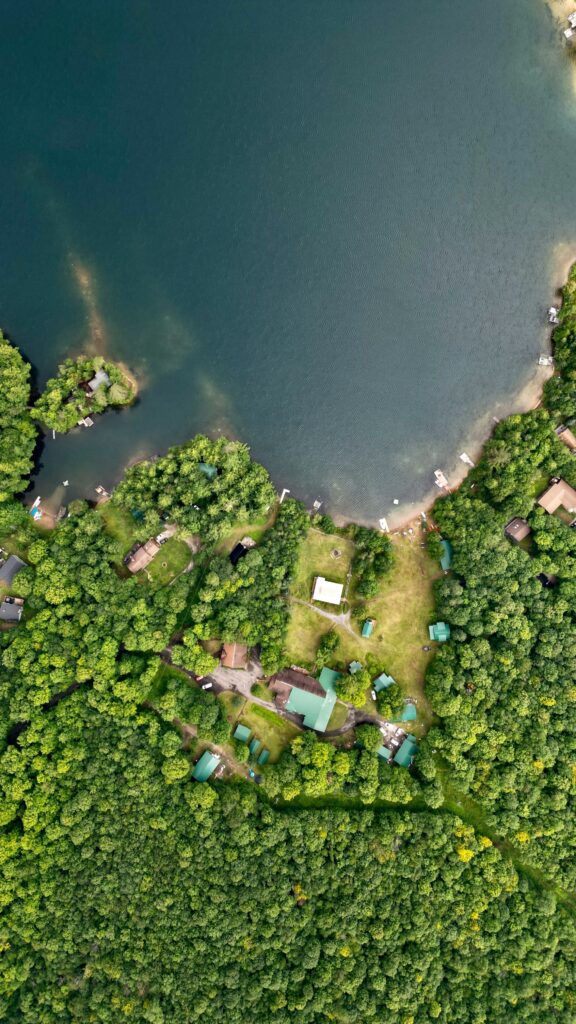

In Florida, the land market has shown resilience despite uncertainties such as interest rate hikes and global tensions. The Ranch & Recreational market, for instance, saw an average price per acre increase by nearly 9% in 2023. Moreover, investments in land conservation surged, with significant funds allocated to safeguard sensitive rural lands (SRD Real Estate). This trend indicates a growing recognition of the ecological and economic benefits of land preservation.

Technological advancements have also transformed land investment. Tools like AI-driven analytics, blockchain for secure transactions, and virtual reality for property visualization have made the process more efficient and appealing to investors. This integration of technology helps in making informed decisions and offers a competitive edge in the market (Real Estate).

When comparing land investment to other forms of investment, like the stock market, it’s essential to consider the different risk profiles and returns. While the stock market offers liquidity and potentially higher short-term gains, it also comes with higher volatility. In contrast, land investment provides stability and long-term appreciation. For instance, during market downturns, land values have shown resilience, making it a safer haven for investors looking for steady growth.

Furthermore, the average annual return on land investments can be quite competitive. Historically, U.S. farmland has offered an average annual return of about 10-12%, which is comparable to the long-term average returns of the stock market. However, land investments are less susceptible to market fluctuations and provide tangible value, especially in times of economic uncertainty (Successful Farming) (SRD Real Estate).

In addition to financial returns, land investments offer other benefits such as diversification of investment portfolios and potential tax advantages. For instance, agricultural land can provide income through leasing for farming or renewable energy projects, adding an extra layer of financial security.

The sustainability trend is another significant aspect. Investors are increasingly prioritizing eco-friendly land projects that not only contribute to environmental conservation but also meet the growing demand for green investments. This focus on sustainability aligns with broader environmental goals and enhances the appeal of land investments (Real Estate).

As we look towards 2024, the emphasis on sustainable development and technological innovations is expected to continue. The demand for rural and remote properties is likely to remain strong, driven by the shift towards remote work and a preference for spacious living environments. This trend underscores the enduring value of land as a versatile and robust investment option.

In conclusion, land investment offers a unique combination of stability, long-term appreciation, and ecological benefits. Compared to the volatility of the stock market, land provides a more secure investment avenue, particularly in uncertain economic climates. By leveraging technological advancements and focusing on sustainable practices, investors can navigate the evolving landscape of land investment successfully.

Here’s a comparison table highlighting the key differences between land investments and other common investment options:

| Investment Type | Average Annual Return | Volatility | Liquidity | Other Benefits |

|---|---|---|---|---|

| Land Investment | 10-12% | Low | Low | Tangible asset, tax advantages, sustainable benefits |

| Stock Market | 8-12% | High | High | High liquidity, potential for high short-term gains |

| Bonds | 3-5% | Low | High | Stable returns, low risk |

| Real Estate | 8-10% | Medium | Medium | Tangible asset, rental income, tax advantages |

| Commodities | Variable | High | Medium | Hedge against inflation, portfolio diversification |

This table provides a clear snapshot of the different characteristics and benefits of each investment type, helping you to make more informed decisions based on your investment goals and risk tolerance.